Our planet is dying.

Or, at least it always is in my favorite books.

At its core, science fiction is about founders—pioneers who envision radical futures and take radical action. And just like Kirk, Picard, Janeway, or really anyone in space wearing a yellow shirt, the founders I look for don’t just iterate in the present; they write the future.

But first, they have to solve some earth-shattering problems.

Here are 3 ways SciFi lessons inform investing:

- How Endless Expansion teaches investors to identify Audience Fragmentation & Cohort Degradation

- How Resource Scarcity teaches you to Pick the Right Problem and Identify Founders who Do a Lot with Little

- Breaking the Prime Directive: Why investors must break their own rules to spot outliers

1. Galactic Empires: How Endless Expansion teaches investors to identify Audience Fragmentation & Cohort Degradation

I’ve been watching and reading science fiction since grade school, and it has patterns. One of the big ones is: if a civilization expands very far, it fractures.

Incumbents—like, say, Earth in an age of rapid extra-planet colonization—rarely embraces its new sister-societies peacefully.

This idea of civilization fragmentation brought on by spatial distancing is something professor Robin Hanson explained to me (at our SciFi Tech Club), and it reinforced the way I see early stage companies’ growth trajectories. Essentially, once humans leave Earth, they might start evolving in ways we can’t predict—not just biologically, but in terms of their values, governance, and even fundamental beliefs about existence. They become a new species not because of what they are, but because of where they are.

The same thing happens with startups & their customers.

When a company scales too far beyond its original audience, it often fractures. The same can happen with vision-creep, hiring bloat, etc. It’s a familiar struggle for founders: How do you expand without losing your essence? How do you stay new and avoid becoming old?

The largest startups solve this and successfully scale beyond their core customers (Earth) while maintaining the connective tissue and magic that gave lift to the first product. This is a difficult challenge.

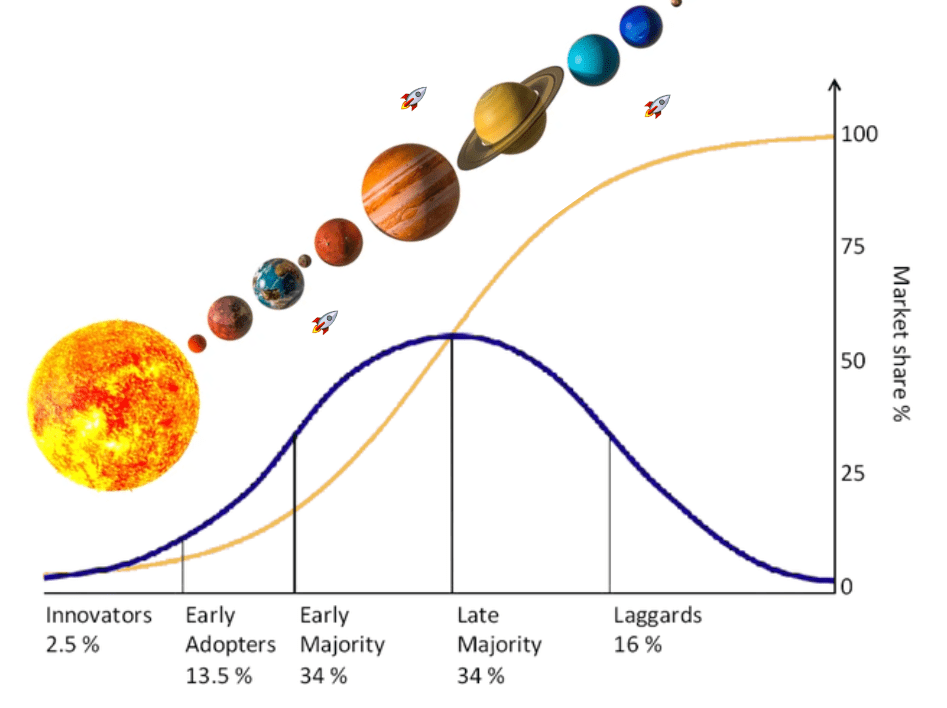

As an investor, I can measure audience expansion (and the lack of “civilization fragmentation”) by customer cohorts – by comparing usage and engagement rates from early adopters to the mass market, from the alpha to the beta to the general release. Cohort degradation appears when the larger cohorts devolve significantly as you scale – some is expected.

I visualize these successful audience leaps as mashing up with space exploration with this overlay:

2. Space Pirates: How Resource Scarcity teaches you to Pick the Right Problem and Identify Founders who Do a Lot with Little

Space is cold and resources are limited. The best sci-fi characters, like the best founders, are resource-limited, creative, problem solvers — people who thrive in scarcity and maximize every tool at their disposal. Think about Mark Watney in The Martian, who survives on Mars by hacking his environment, or the characters in The Broken Earth Trilogy, who can reshape the entire planet with their minds.

In sci-fi, and in investing, constraints always reveal ingenuity.

Something Casey Handmer, CEO of Terraform Industries, said stuck in my head with me – if we really did figure out how to survive on Mars, we would also solve almost all other space problems.

The lesson is to constrain a huge problem – like expanding into the universe – by constraining it to a singular problem – like surviving on Mars.

As an investor, I do the same thing when assessing a company. Rather than boil the ocean, I focus on the 1 or 2 things I must believe (“need to believes” or “picking the right problem”) to get the investment thesis right.

As an investor I also look for this in founders: those who do a lot with very little. “Capital efficiency” or “burn rate” is the way to measure this. Grew revenue by $3M while only spending $500k? Have a burn rate of under 1?

Scarce resources breed ingenuity.

3. Prime Directive: Why investors must break their own rules to spot outliers

On Star Trek, the Prime Directive forbids the Federation from interfering with less advanced civilizations.

The crew, in many episodes, quickly shatters this rule to pieces. Why? They often did it when faced with an ethical dilemma – feeling compelled to intervene in a civilization’s affairs to prevent a catastrophic event like mass extinction, enslavement, or other large-scale disaster.

As an investor, we naturally begin to pattern match off of prior successful investments

But breaking your own rules and ignoring pattern matching is what allows you to truly spot outliers.

Mike Maples of Floodgate has a terrific book describing this philosophy called Pattern Breakers.

The best founders question the premise and invent new categories. They break entrenched patterns of “what works.”

A great example from our portfolio is Honeylove, who broke the comfort trend to add structure to undergarments. Read more about their story here.

There are a lot more ways SciFi lessons inform investing, but those are a few to start.

Leave a comment