Metrics are not all made equal

I’m on the board of a startup where, a few weeks ago, our board group chat got into a fun debate over text.

It wasn’t about product direction or hiring plans, but about metrics. Ranking metrics.

One of the founders shared this metrics snapshot and asked, “which metrics should we be prioritizing most?” [TL;DR: see bottom of this article for final ranking]

It covers 8 core categories of startup KPIs: from daily active users to brand awareness to gross margin, etc.

The question was: how would you rank the metrics from most to least important, in context of our startup’s tendencies? For context, my portfolio company is late-stage and consumer focused. But this debate still applies at all stages, even in the 0 to 1 PMF stage, pre financials.

Myself and another board member debated back and forth with the founders. Our answers were similar, but with one very important distinction.

I initially ranked one key metric – Customer Love – far too low.

The startup’s cofounder and my fellow board member ended up pointing this out, and we actually recalibrated as an entire board on the ranking to make customer love the #1 metric after our debate.

Investor 1 (my friend) ranked the metrics as follows:

- C) Customer Engagement

- G) Unit Economics

- B) Customer Love

- D) Technology

- F) Financial Performance

- A) Size & Growth

- E) Branding

- H) Product Breadth

While I submitted this version:

- C) Engagement

- G) Unit economics

- F) Financial performance

- D) Technology

- B) Customer love

- A) Size & Growth

- E) Branding

- H) Product breadth

So when the founder asked me why I had ranked these metrics this way, I shared its because I think of metrics in terms of output vs. input levers:

- Outputs are what we have to achieve to win: Brand, Unit Economics, Financial Performance, Market Share (Size and Growth).

- Inputs are how we get there: Technology, Customer Love, Engagement, Product Depth.

I’m a strong believer that Customer Engagement is one of the most important leading indicators for any product company. Full stop. If users are using your product obsessively, you’ve captured their attention, and likely their wallet share too. That’s the foundation everything else is built on.

Then comes Unit Economics (G). The trick is to deliver engagement in a financially sustainable way. If your CAC is too high, or your payback period is broken, you’re just buying usage that won’t stick. UE is a direct output of engagement and (conversion, usage, retention) and your business cost structure. While an output, UE is a critical atomic level snapshot of health that is easier to move than the full P&L.

From there, Financial Performance (F) follows naturally. Where our portfolio startup currently sits, reliable, predictable margins matter a lot more than they do for early-stage firms. Later stage investors care a lot more about if you delivered on what you said you’re going to do, not seed storytelling.

Finally, Technology (D). This is where I believe our competitive advantage lies. Great tech enables great engagement. It also creates leverage, which makes unit economics stronger and improves product velocity.

However, my fatal flaw was ranking Customer Love too low.

The biggest point of contention between our two lists was: Customer Love (B) – ranked third v. fifth.

Their view was that Customer Love had to be far higher because you could hit all the other metrics, even (F), without your customers truly loving you.

Tony Hsieh’s “Delivering Happiness” book is a masterclass in what customer love looks like and how to generate it – it comes from you obsessing over what would solve your customers needs.

This especially true in markets where incentives can drive usage regardless of how users feel like social media or BNPL. But that doesn’t create lasting value. And it doesn’t build trust.

My portco founder painted it perfectly:

“Love and Engagement are correlated, but love is emotional. It’s about perceived value, experience, and identity. Engagement can be gamed, love cannot.”

Customer Love is an incredibly strong input that can drive engagement, reduce CAC, become part of the brand story, and so much more.

This was especially important in context of the strengths of my portfolio company – they are exceptional at hacking growth and numerical numbers, so leaning into the “touchy feely” of customer love was especially important to focus on.

Know your strengths and make sure they’re not blinding you.

Why it Matters

In 2024, we saw a shift in how both founders and investors think about metrics. According to Bessemer’s State of the Cloud report, 52% of public SaaS companies saw their revenue multiples decline, but those with top-decile gross retention and payback periods under 12 months were 2.5x more likely to outperform the index.

What does that tell us? Retention (which is a lagging indicator of engagement) and efficiency drive financial results.

And companies that figured that out early (like Canva, Rippling, and Deel) all started by maximizing how often and how deeply customers used them.

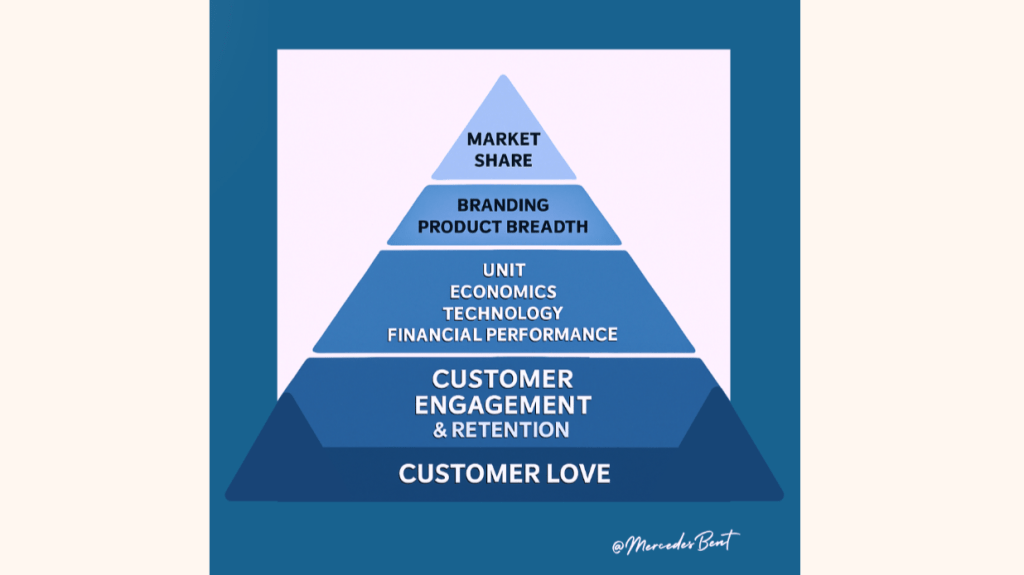

TL;DR: My Personal Hierarchy

Here’s where I’ve now landed with my personal hierarchy of metrics:

- Customer Love (B): The ultimate input of doing the above well.

- Engagement (C): Leading indicator #1. If they’re not using you, nothing else matters.

- Unit Economics (G): Can you deliver C profitably?

- Financial Performance (F): At scale, predictability wins.

- Technology (D): Core enabler and moat. I would flip Technology and (F) for an early-stage company (sub $10-20M revenue), where it’s more important to establish your moat.

- Market Share (A): An outcome, not a strategy.

- Branding (E): Important, but lagging.

- Product Breadth (H): Nice to have, not a priority.

Thoughts? Feedback on this ranking?

Leave a comment