-

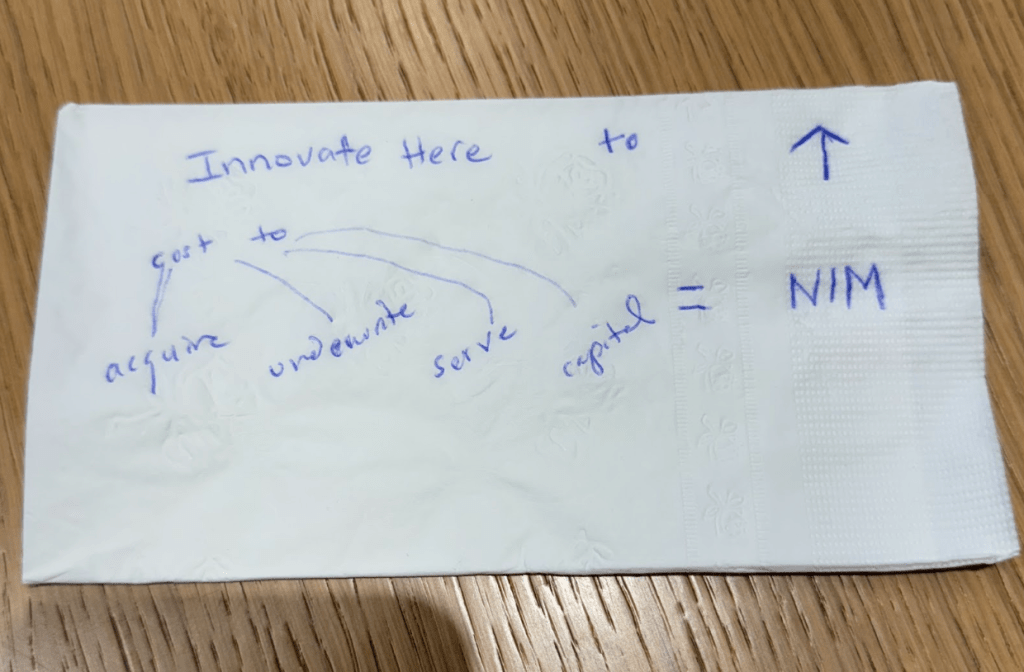

NIM Innovation: A Lending Mental Model

Foreword: I’ve long been a mentor of startups in the Entrepreneurship and VC class at Stanford. Recently I was hosting several GSB students from the class who were working on a lending startup, and we got to “whiteboarding.” Well, napkin writing. I shared my lending mental model with them and realized I’ve never encapsulated it…

-

Fintech 2024: Innovation meets consolidation

Originally posted January 31, 2024 on LSVP website AI will continue to drive the industry forward in new directions, while some high-flying startups may be in for a rough landing For Fintech, 2024 will be a year of both consolidation and innovation. AI-driven solutions will continue to propel the sector forward, making significant advancements in…

-

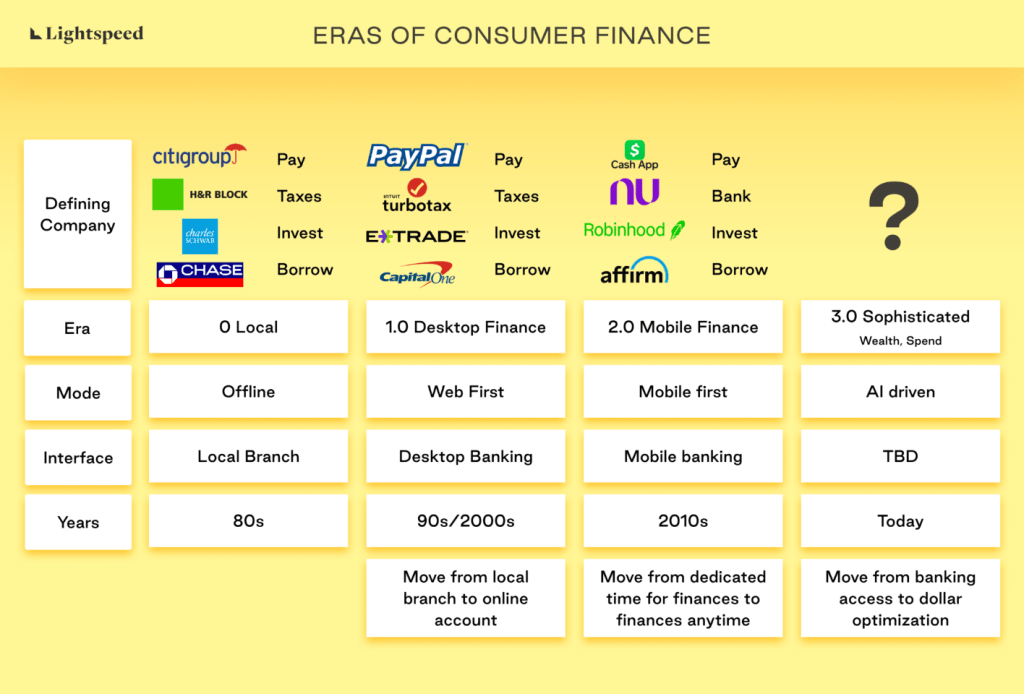

THE SOPHISTICATION ERA OF CONSUMER FINTECH

This is Part 2 in my Consumer Fintech Series. See Part I here. First published on Lightspeed’s blog Consumer fintech is entering a new, 3rd era that will be defined by consolidation, optimization and intelligent software. Consumer fintech is in a transitory phase. Consolidation is taking place as value accrues to larger incumbents. We’ve reached…

-

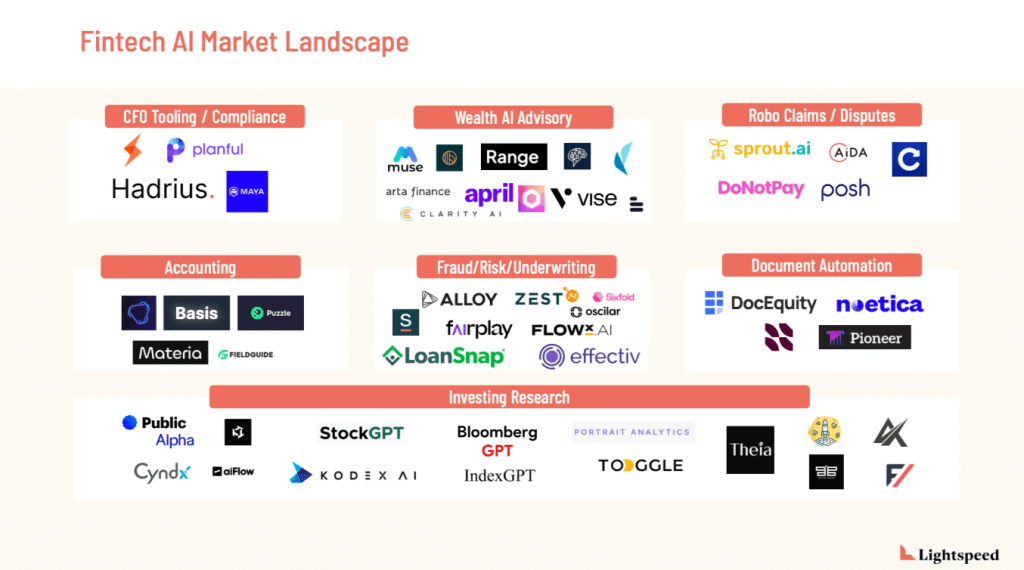

Fintech x AI: The Lightspeed View

We wrote a piece on how we think AI will impact fintech. Check it out: https://medium.com/lightspeed-venture-partners/fintech-x-ai-the-lightspeed-view-b515fae5bfb6

-

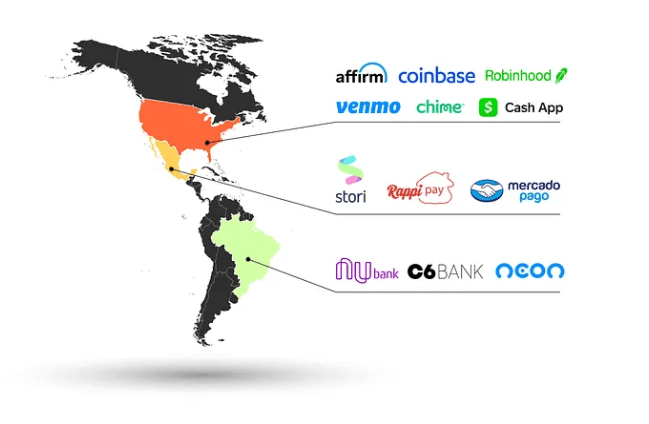

The Successful Consumer Fintech Path

This is Part 1 in my Consumer Fintech Series. See Part II here. This article was first posted on my Medium Neobrokers, neobanks, embedded fintech, & fixed income are 2023’s retail investment winners, but the race is far from over for consumer fintechs in the Americas. Two years ago I wrote about the retail investing zeitgeist that…

-

Fintech Trends for 2023 and Beyond

Lightspeed’s investment team shares what’s fascinating them and what to watch for in the year ahead Check out the full post here: https://medium.com/lightspeed-venture-partners/fintech-trends-for-2023-and-beyond-25515d0c1e75 Lightspeed’s 2023 Fintech Themes

-

Power to the People: My Investing Focus 2022

You Deserve Two and a half years ago I joined Lightspeed and laid out how my investing focus mapped to communities and sectors I care about. I’ve been so proud to watch it come to life through investments in: Players driving financial inclusion through fintech + retail investing such as Trading TV, Stori, and Flink (including Lightspeed’s first investments in LATAM); Companies shepherding in…

-

Congratulations Stori on your Series C

Congratulations to Stori on your $125M Series C equity raise led by GGV and GIC! We led the Series B earlier this year and I’ve been thrilled to see Stori perform incredibly well since we invested. The company has more than 10x’d active credit cards and seen over 2M people apply for a card. They also introduced…

-

Meet Stori: Mexico’s Credit Card for the Masses

Mexico is the fastest growing e-commerce market in the world. Mexico earned the #1 spot ahead of India, China, Philippines, and Malaysia. This increase in online purchases means that Mexicans are increasingly looking for more ways to digitally pay. In China, home grown digital payments companies like Alipay and WeChat Pay have the dominant share of e-commerce.…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.