-

FMB 15: How Founders Choose Investors

This is an extension of my #FMB “Founders are Made, not Born: How Founders Become Learning Animals” series. Originals based on research at Stanford: Part I, Part II, Part III, Part IV, Part V, Part VI, and Part VII. Extensions: Parts 7, 8,9, 10,11, 12, 13, 14. During fundraises, founders often ask how to choose investors. I’ve met 1,000+ of investors and been part of dozens of boards.…

-

Search is at War

Defensibility in the Age of AI Search Search is at war. LLMs are quickly changing how consumers search. A lot is at stake, including the market caps of 2 of the top 5 most valuable companies in the world. Google (GOOG: $1.9T market cap) and Amazon (AMZN: $2.04T) each dominate different types of search: knowledge…

-

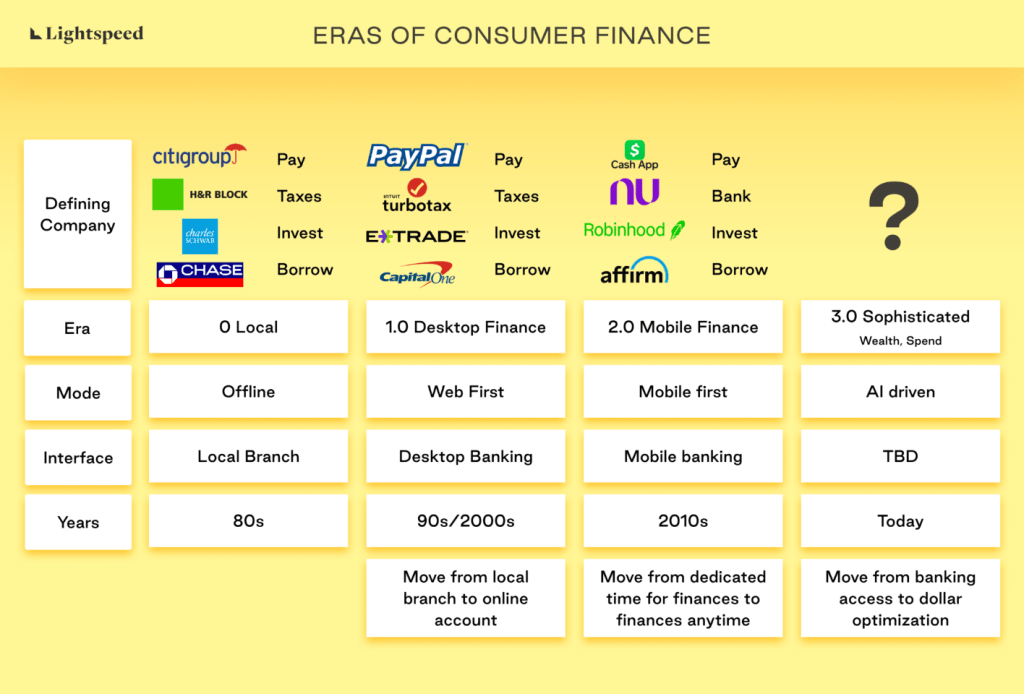

THE SOPHISTICATION ERA OF CONSUMER FINTECH

This is Part 2 in my Consumer Fintech Series. See Part I here. First published on Lightspeed’s blog Consumer fintech is entering a new, 3rd era that will be defined by consolidation, optimization and intelligent software. Consumer fintech is in a transitory phase. Consolidation is taking place as value accrues to larger incumbents. We’ve reached…

-

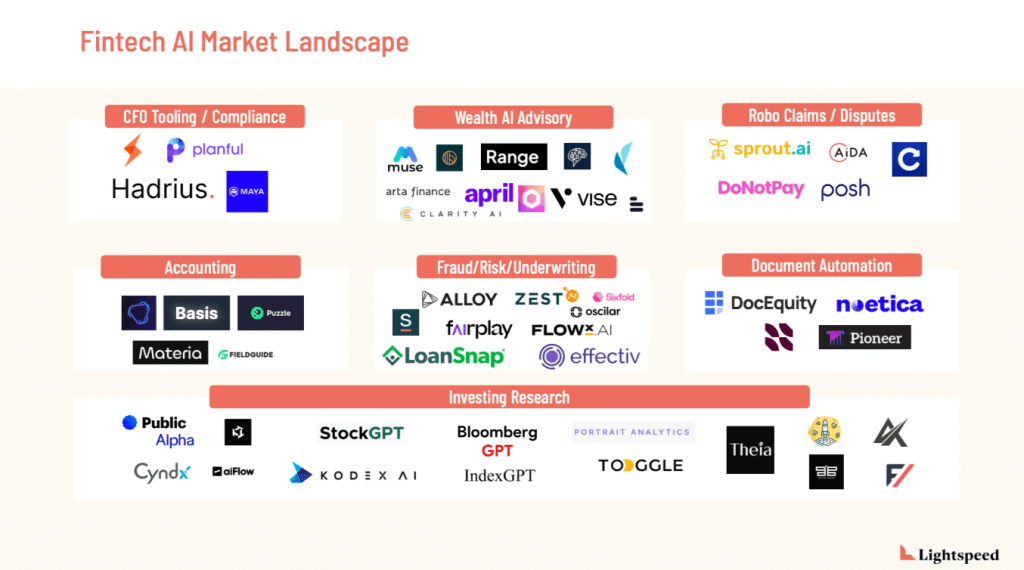

Fintech x AI: The Lightspeed View

We wrote a piece on how we think AI will impact fintech. Check it out: https://medium.com/lightspeed-venture-partners/fintech-x-ai-the-lightspeed-view-b515fae5bfb6

-

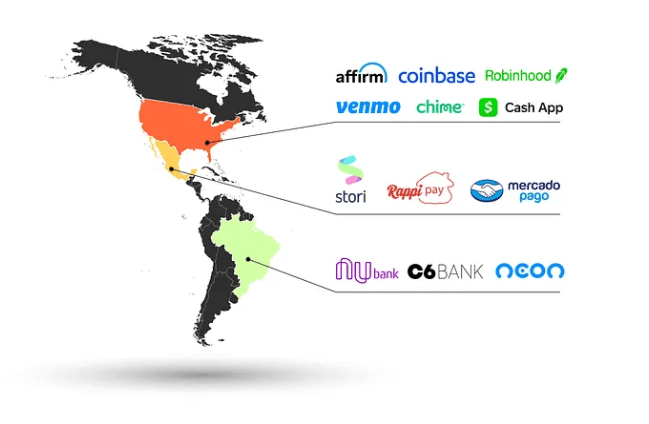

The Successful Consumer Fintech Path

This is Part 1 in my Consumer Fintech Series. See Part II here. This article was first posted on my Medium Neobrokers, neobanks, embedded fintech, & fixed income are 2023’s retail investment winners, but the race is far from over for consumer fintechs in the Americas. Two years ago I wrote about the retail investing zeitgeist that…

-

Fintech Trends for 2023 and Beyond

Lightspeed’s investment team shares what’s fascinating them and what to watch for in the year ahead Check out the full post here: https://medium.com/lightspeed-venture-partners/fintech-trends-for-2023-and-beyond-25515d0c1e75 Lightspeed’s 2023 Fintech Themes

-

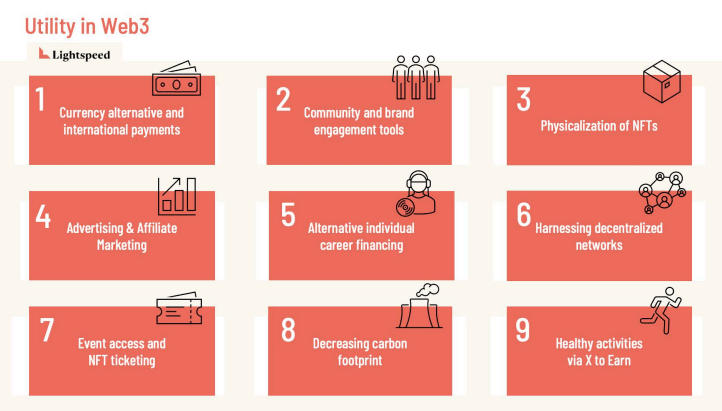

The Future of Crypto Native Consumer Products, Part 3: Utility

What are Web3, NFTs, and crypto actually good for? Quite a lot, actually. Read Part I and Part II of the future of crypto consumer product series People who know of my interest in NFTs in the arts and crypto in general often ask me, “Okay, but are these things *actually* useful in the real…

-

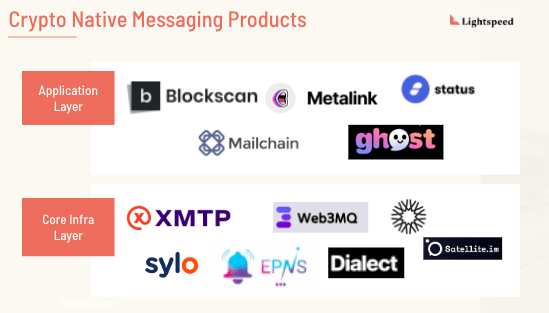

The Future of Crypto Native Consumer Products, Part 2: Messaging

Crypto’s ‘You’ve got mail’ moment is coming To steal a line from Mark Twain, the demise of crypto has been greatly exaggerated. Yes, token values are falling, and crypto companies built on the assumption of an ever-rising tide are starting to trim their sails. And yes a “crypto winter” is upon us. But I am confident that…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.