I constantly see really smart people launch consumer products, get little to no reception, and wonder why. There are a ton of possible culprits.

One common one I see is that their product lacked a captivating hook that chooses a side: to be singularly entertaining or provide extreme utility.

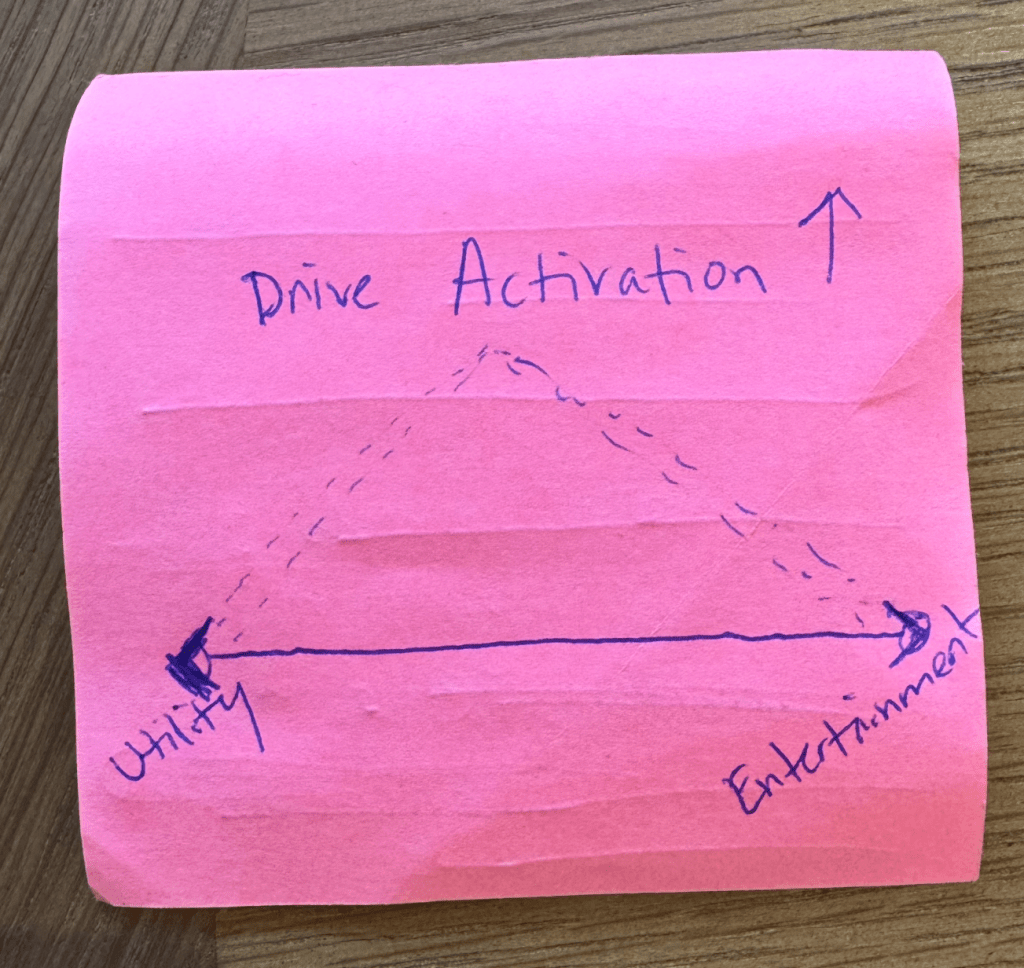

It is my strong belief that digital consumer products must have polarity on what I call the “Entertainment versus Utility spectrum”: they either need to solve a painkiller-level problem thus unlocking utility, or fill consumer’s entertainment appetite.

If your product hook sits in a middle ground—if its job-to-be-done is even remotely unclear—it’s dead on arrival.

Why?

- Logical product hooks fail in consumer land. Consumers don’t do things they know they should do. Consumers activate into new products when they WANT to and when things are made extremely EASY to do.

- Consumers have extremely short attention spans. They don’t have time for ambiguity. They want something that is obviously either essential (solves a pain point now) or entertaining.

- Vitamin (“it’s a good idea to do this”), middle-ground positioning does not win in the hyper competitive world of consumer attention

What History Tells Us

Look at the biggest consumer companies of the last 20 years. Every single one of them started with a clear, polarizing position on the entertainment-to-utility scale.

Entertainment-first giants + First Hook

- Facebook – Reconnect with old classmates. First hook: rank hot girls in college

- TikTok – Infinite dopamine scroll. First hook (musically): create short lip-syncing videos

- Snapchat – Disappearing messages for fun. First hook: disappearing message

- Twitter – The global opinion firehose. First hook: only 140 characters

- Spotify – Streaming music. First hook: free music

- Zynga – Addictive social gaming. First hook: first online social poker w/friends

- Duolingo – A gamified education app. First hook: game-like language learning

Utility-first giants

- LinkedIn – Digital resume & networking. First hook: online resume

- Coinbase – Send, store, and trade crypto. First hook: pay anonymously

- Nubank – Mobile-first banking & credit. First hook: credit

- Square – Seamless small-business payments. First hook: accept payment on the go

- Uber – Get a ride instantly. First hook: luxury black car service

- Airbnb – Book a stay anywhere (utility, with an entertainment layer). First hook: find a couch to crash on.

- DoorDash – On-demand food delivery. First hook: food now

- Robinhood – Stock trading, simplified (and easy can be the same as fun for some people). First hook: free trading

- Wise – Fast, low-cost international money transfers. First hook: international payment w/o hassle

None of these companies launched with a “nice-to-have” experience.

Last year, 71% of consumer-facing startups that failed cited lack of market demand as a primary reason. That’s another way of saying their value proposition wasn’t clear enough to drive activation.

The Vitamin Trap: Why Most New Consumer Products Fail

Here’s what doesn’t work: a product that sounds nice but isn’t necessary.

These are “vitamins” that might be helpful over time, but they don’t immediately remove a person’s pain — they don’t solve an urgent enough problem.

The best consumer products? They are painkillers. They tackle a problem that’s crystal clear to the consumer. I don’t want this pain to stop. I need it to. That’s how clear your product has to cut in someone’s mind to succeed.

Consumer attention spans have dropped by 30% over the last 15 years. Most people (73%) decide whether to keep a new app long term in the first two weeks of opening it for the first time. This is why companies measure how often users come back in the first two weeks. Facebook famously measured if you added 7 friends in the first 10 days of onboarding to their product to predict long term retention.

Additionally, 21% of new users across almost all consumer applications will never open an app again after using it only once.

If you’re thinking, “Well, what about [insert company]?”—sure, there are some exceptions:

- Pinterest – A discovery platform that’s more vitamin than painkiller.

- Etsy – A marketplace for unique goods, not exactly solving an urgent problem.

But these are the exceptions, not the rule. It’s extremely rare that consumer companies make it. Out of all consumer startups, only about less than ~10 per year IPO for over $1 billion. The vast majority of those that break this limit follow the entertainment vs. utility rule.

Consumer Psychology: The More Polarized You Can Be, The Better

Why does this rule work? Because human beings crave clarity.

This is where behavioral design comes in. One of my favorite frameworks for this is called Octalysis, a gaming model, which breaks down 8 core reasons people take decisive action (like making a purchase):

- Epic meaning & calling – Why LinkedIn feels essential for career-building.

- Accomplishment – Why Duolingo’s gamification works.

- Empowerment – Why Robinhood made investing feel accessible.

- Social influence – Why TikTok and Facebook exploded.

- Scarcity & impatience – Why Uber is indispensable in a hurry.

- Unpredictability – Why people keep scrolling Twitter.

- Avoidance – Why painkiller products are always in demand.

The lesson? The more polarizing the product, the stronger chance at activation because the stronger your pull toward fun or function, the more you tap into the core motivations driving modern consumers.

Messaging Isn’t Enough—You Have to Be Real

Some people think this all just boils down to a messaging problem. That if you brand your product better, people will care more. Some people think you can trick your way into a massive IPO.

Some unicorns are just horses wearing birthday hats.

You can’t fake genuine market activation. You can’t trick people into loving a product that doesn’t give them something they deeply need.

The most successful consumer companies still rely intrinsically on organic means to grow. TikTok’s initial U.S. growth was 90% organic, fueled by a pure entertainment loop, while Nubank’s expansion in Latin America relied on a utility-led strategy that was so useful to its tether audience, it could not be ignored.

What Founders Need to Do Today

This is one of the hardest lessons for founders to learn in consumer product building and one of the first things I look for in consumer founders. Do they have the consumer “touch” where they intuitively understand user psychology? Do they speak in the language of wants/needs/desires and understand what is “logical but boring” versus “pointless but captivating”?

If you’re building a consumer startup in 2025, here’s your checklist:

- Is my product unmistakably entertainment or utility?

- Does my product solve a painkiller-level problem?

- Can users immediately see why they need it?

- Does my growth plan prioritize consumer psychology?

One important note is that this rule applies to the initial hook, the wedge product experience that activates the user upon capture. Products are much more complex in their totality and people stay on for a myriad of reasons.

Final Takeaways: How to Build for Today’s Consumer

- You have to be razor-sharp. If your product’s value isn’t obvious in seconds, it’s too weak.

- Pick a side. Either solve an immediate pain or be so fun people can’t stop using it.

- Leverage human psychology. People don’t change—use frameworks like Octalysis to design products that naturally activate.

The next wave of AI-based consumer unicorns will follow these same principles. They’ll be ruthlessly clear, solve an immediate problem, and tap into base human psychology.

Leave a comment