-

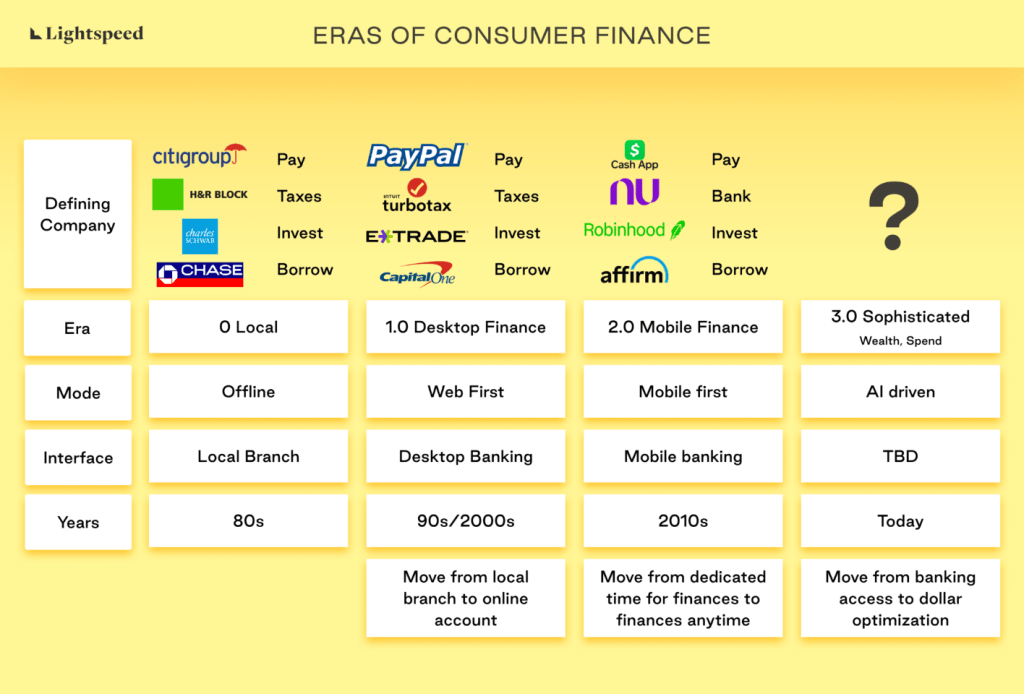

THE SOPHISTICATION ERA OF CONSUMER FINTECH

This is Part 2 in my Consumer Fintech Series. See Part I here. First published on Lightspeed’s blog Consumer fintech is entering a new, 3rd era that will be defined by consolidation, optimization and intelligent software. Consumer fintech is in a transitory phase. Consolidation is taking place as value accrues to larger incumbents. We’ve reached…

-

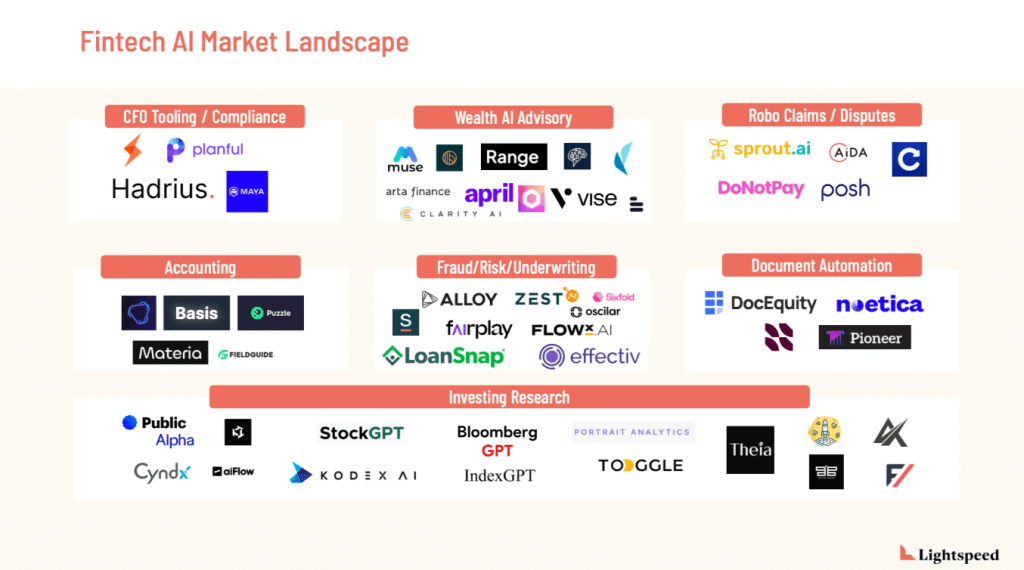

Fintech x AI: The Lightspeed View

We wrote a piece on how we think AI will impact fintech. Check it out: https://medium.com/lightspeed-venture-partners/fintech-x-ai-the-lightspeed-view-b515fae5bfb6

-

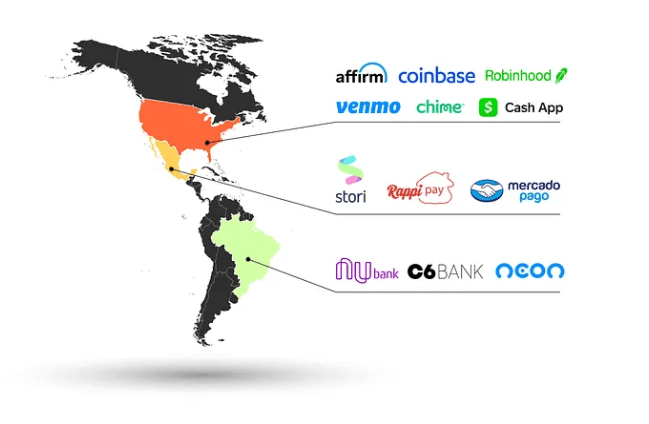

The Successful Consumer Fintech Path

This is Part 1 in my Consumer Fintech Series. See Part II here. This article was first posted on my Medium Neobrokers, neobanks, embedded fintech, & fixed income are 2023’s retail investment winners, but the race is far from over for consumer fintechs in the Americas. Two years ago I wrote about the retail investing zeitgeist that…

-

Fintech Trends for 2023 and Beyond

Lightspeed’s investment team shares what’s fascinating them and what to watch for in the year ahead Check out the full post here: https://medium.com/lightspeed-venture-partners/fintech-trends-for-2023-and-beyond-25515d0c1e75 Lightspeed’s 2023 Fintech Themes

-

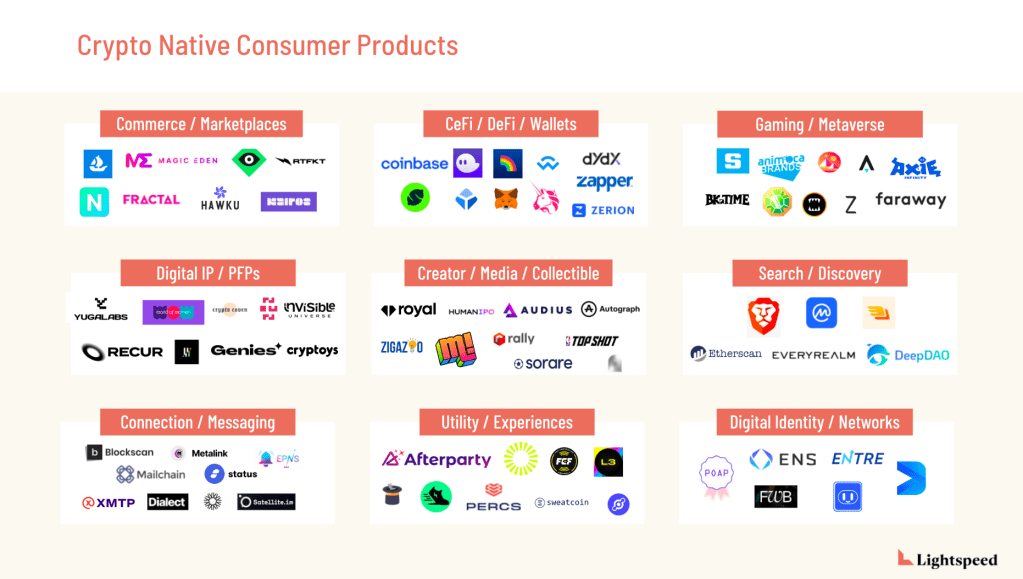

The Future of Crypto Native Consumer Products Part 4: Digital Identities

No More Catfishing. Digital Identities — It’s not a matter of if, but whom. This is Part 4 of the Series. Read Part 1, Part 2 (Messaging), & Part 3 (Utility). If you’re like me, you’ve had a friend who’s about to go on a first date with someone they met on Bumble. They’ll usually say something like, “I’ve already…

-

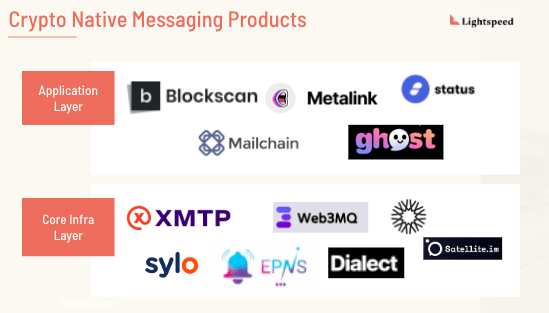

The Future of Crypto Native Consumer Products, Part 2: Messaging

Crypto’s ‘You’ve got mail’ moment is coming To steal a line from Mark Twain, the demise of crypto has been greatly exaggerated. Yes, token values are falling, and crypto companies built on the assumption of an ever-rising tide are starting to trim their sails. And yes a “crypto winter” is upon us. But I am confident that…

-

The Future of Crypto Native Consumer Products

Every major technology shift has eventually brought forth a new wave of consumer tech companies. The emergence of the Internet led to messaging apps like AOL and Yahoo, marketplaces like Amazon and eBay, and entertainment services like Netflix and Pandora. The move to mobile led to the rise of Twitter, Uber, Facebook, and Snap*, among…

-

Meet trading.tv: Livestreamed Trading

[Originally posted Feb 15, 2022] We are excited to announce our investment in trading.tv, a next generation social media platform for retail investing. Trading.tv enables creators to distribute investment content through a livestream-enabled social media platform. By linking creator content to a trading brokerage, trading.tv allows users to instantly invest on ideas they hear about in…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.